If you are self-employed, it will help if you make some efforts to know what a Solo 401(k) plan has to offer.

A Solo 401(k) is an individual 401(k) designed for a business owner with no employees. And you need to avail of the services of a Solo 401(k) provider to set up the account.

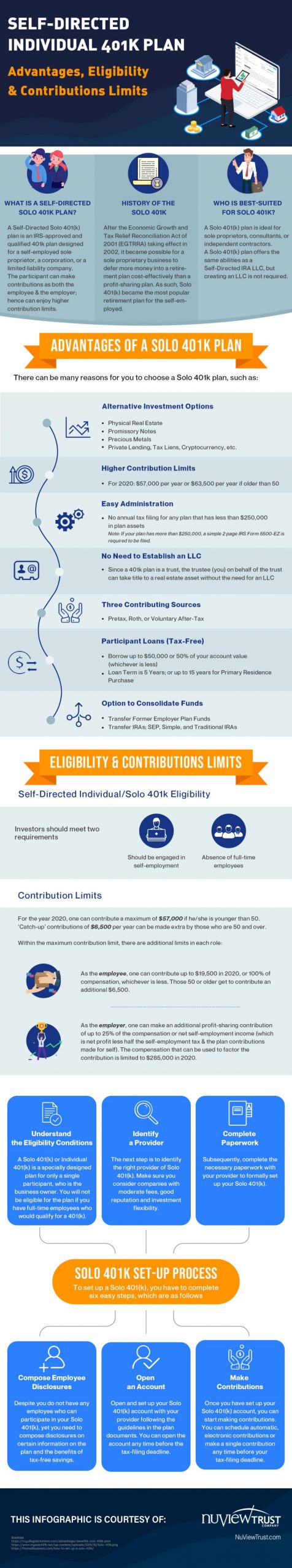

Who Does the Solo 401(k) Plan Suit?

A Solo 401(k) plan is perfect for business owners with no employees, such as sole proprietors, consultants, or independent contractors. The plan offers the same benefits as that of a Self-Directed IRA LLC. But there is an exception. There is no need for you to hire a custodian or create an LLC.

The plan allows you to:

- Rollover your existing IRA or 401(k) plan funds tax-free into a new Solo 401k plan and use those funds in real estate to make tax-deferred investments.

- Borrow up to $50,000 and make annual plan contributions up to $60,000, which is more than nine times the amount of an IRA contribution

A Bit of History

It will help if you acquaint yourself with a little bit of history of the plan’s emergence.

Before 2002, there were no ways for any self-employed business owner to establish a 401(k) plan.

But the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA), which took effect in 2002, had changed everything. The EGTRRA made it possible for an owner-only business to defer more money into a retirement plan cost-effectively than a profit-sharing plan. And subsequently, the Solo 401(k) plan became the most popular retirement plan for the self-employed.

The EGTRRA had brought about a notable change that benefits the self-employed. It added the employee deferral feature found in a Traditional 401k Plan to the Solo 401k plan. The feature rendered the plan to provide the highest contribution benefits to the self-employed.

Are you curious to know more about the plan? Then wait no further, refer to the infographic in this post.